Does investing feel overwhelming? It doesn’t have to be. With us, you get expert guidance every step of the way. In this article, we’ll cover key investing topics, including the risk-return trade-off, investment types, diversification strategies, and how to build a solid investment plan.

Why Invest?

Saving alone won’t grow your money fast enough to build financial freedom. Inflation slowly makes your cash worth less every year. For example, $10,000 in a savings account earning 1% loses value if inflation is 3%. In 20 years, it will buy less than $7,000 worth today.

But put that same $10,000 in a well-diversified fund earning about 7% a year, and compounding can grow it to nearly $40,000 in 20 years. Investing helps you build real wealth over time. This is why investing early and consistently matters.

What Is Investment Planning?

Investment planning is the process of matching your financial goals with the right strategy based on your resources, investing knowledge, time horizon, and risk tolerance. It’s a structured plan for how and where to put your money so it grows over time while balancing risk and reward.

Good investment planning considers your income, expenses, risk tolerance, timeline, and life goals. The goal is to build wealth steadily and help you reach milestones like buying a home, paying for college, or retiring comfortably.

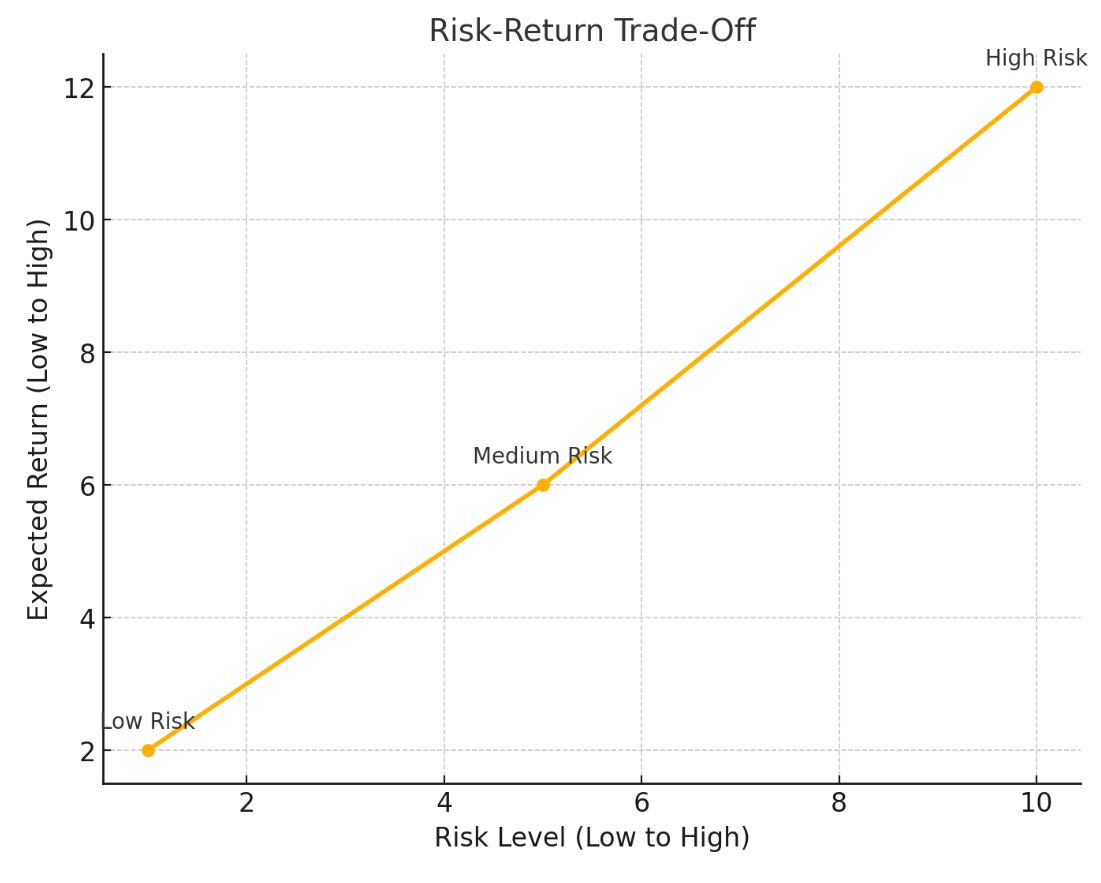

Understanding the Risk-Return Trade-Off

One of the core principles of investing is simple but powerful: higher potential returns usually come with higher risk. This is called the risk-return trade-off.

Putting your money in a savings account is very low risk, but the returns are small. Investing in stocks or starting a business can offer much higher returns, but there’s also a greater chance you could lose money. A smart investor knows how much risk they’re truly comfortable with and how much risk they need to take to meet their goals.

For example, if you’re 25 and investing for retirement, you can probably handle more risk (like stocks) because you have decades to ride out market ups and downs. If you’re five years from retirement, you’ll likely want lower-risk investments (like bonds or stable funds) to protect your nest egg.

The key here is balancing this trade-off based on your goals, resources, timeline, and how much risk you’re comfortable taking.

Types of Investments

When you start investing, you’ll come across a handful of core investment types, each with its own purpose and trade-offs.

Stocks

Stocks are shares of ownership in a company. When you buy a stock, you’re hoping the company grows and becomes more valuable over time, which can boost the share price. Many companies also pay dividends.

Stocks tend to offer the highest long-term returns, but their prices can swing up and down a lot in the short term. That’s why they’re best suited for long-term goals like retirement or saving for a child’s college fund. If you’re new to investing, it’s wise to own a mix of stocks rather than betting on a single company.

Bonds

When you buy a bond, you’re lending money to a government, city, or company for a set period in exchange for regular interest payments plus your money back later. Bonds don’t grow your money as quickly as stocks, but they’re more predictable and can help steady your portfolio during stock market dips.

Common choices include U.S. Treasury bonds (very safe) and corporate bonds (a bit riskier but with higher payouts). Bonds are great for balancing risk, especially as you get closer to needing the money.

Mutual Funds

Mutual funds make investing simple. They pool money from many investors to buy a diversified mix of stocks, bonds, or both, all managed by professionals. This means you get instant diversification without having to pick and monitor each investment yourself.

There are funds for every goal. Some focus on growth and some on steady income. The most popular type of mutual fund in the U.S. is the index mutual fund, especially those that track the S&P 500.

For example, the Vanguard 500 Index Fund (VFIAX) and the Fidelity 500 Index Fund (FXAIX) are two of the biggest and most widely owned. They give investors instant diversification by spreading money across hundreds of large, established U.S. companies, with minimal fees.

Exchange-Traded Funds

ETFs, or exchange-traded funds, are very similar to mutual funds but trade on stock exchanges like individual stocks. Most ETFs track an index, like the S&P 500, or focus on a specific industry or theme.

They’re typically lower-cost than mutual funds and give you flexibility to buy or sell throughout the trading day. Many DIY investors use ETFs to build a diversified portfolio with just a few well-chosen funds.

Other Investment Types

Outside of these basics, you might hear about other options like real estate, cryptocurrencies, or hedge funds. Real estate can be a solid way to build wealth, whether you buy rental properties, flip houses, or invest in real estate funds called REITs. It often requires more upfront money and hands-on effort, but can generate steady income.

Cryptocurrencies like Bitcoin are exciting but highly volatile; prices can jump or crash overnight, so only invest what you’re truly willing to lose. Hedge funds and private equity use more complex strategies and are usually reserved for high-net-worth investors who can handle higher risk and higher fees.

Diversification

Diversification means spreading your investments across a mix of assets so no single setback can sink your entire plan. It’s one of the most reliable ways to manage risk without giving up the chance for growth.

Instead of putting all your money in one stock or one type of investment, you own a mix of domestic and international stocks, bonds, real estate, or even alternative assets. These don’t all move the same way at the same time. When one piece struggles, another may hold steady or do well, which cushions your portfolio against big swings.

There are many ways to diversify your portfolio:

- Across asset classes: Combine stocks, bonds, real estate, or even cash savings.

- Within each asset class: Own stocks from different industries and regions, not just one company or country.

- Over time: Keep investing regularly, which spreads out your buying costs (this is called dollar-cost averaging).

An easy way to get instant diversification is through mutual funds or exchange-traded funds (ETFs). These funds pool money from many investors to buy dozens or hundreds of investments at once, giving you broad exposure without picking each stock yourself.

A well-diversified portfolio won’t eliminate risk, but it can make the ride much smoother and help you stick with your plan for the long run.

Passive Investing and Dollar-Cost Averaging

At our firm, we follow a passive investment philosophy guided by the S&P 500 and similar trends and benchmarks, rather than trying to ‘beat the market’.

But why passive investing? Research shows that most active managers, the ones trying to ‘beat the market’, often underperform their index in the long run, especially after fees. Passive investing keeps costs lower, reduces unnecessary trading, and keeps your money aligned with long-term growth trends.

To make passive investing even more effective, we encourage dollar-cost averaging. This means investing a fixed amount at regular intervals, like monthly or quarterly, regardless of market ups and downs. Sometimes you’ll buy when prices are high, sometimes when they’re low, but over time, this smooths out the cost of your investments and helps remove the temptation to ‘time the market.’

Combined, passive investing and dollar-cost averaging take the guesswork and emotion out of investing. You stay invested through the ups and downs, your portfolio tracks reliable benchmarks, and you give your money the best chance to grow steadily over time.

How to Make an Investment Plan

An investment plan is personal because your goals, timeline, income, and comfort with risk are unique to you. There’s no perfect template that works for everyone. A good plan matches what you’re working toward, when you’ll need the money, and how much risk you’re willing to take.

Start by asking yourself the right questions:

1. What are you investing for?

Are you saving for retirement, a home, your child’s education, or just building wealth in general? Be specific. Knowing the “why” helps you pick the right mix of investments and time horizon.

2. When will you need this money?

Is your goal five years away, or thirty? How long you have affects how much risk you can take. If you need the money soon (1–5 years), keep it mostly in low-risk investments like cash or short-term bonds. If your goal is decades away, you can afford more stocks for higher long-term growth.

3. How comfortable are you with risk?

Could you sleep at night if your portfolio drops 10% in a week, or do market dips make you panic? If big swings make you nervous, lean toward a more balanced mix of stocks and bonds and stay diversified.

4. How much can you invest regularly?

What amount can you commit to investing each month without hurting your day-to-day budget? Automate it if possible. A consistent monthly contribution, even a modest amount, benefits from dollar-cost averaging and keeps you on track.

5. Are your investments diversified enough?

Are you spreading your money across different asset classes and sectors to manage risk? Use broad index funds to get exposure to hundreds of stocks and bonds at once. This reduces the impact of any single loss.

6. Are you following a passive approach or chasing trends?

Are you sticking with proven index-based investments or trying to time the market? Actively managed funds tend to underperform their index and have higher fees. Research shows passive, index-based investing outperforms most active trading over time with lower costs and less stress.

7. When will you review and adjust your investment plan?

Once or twice a year is enough for most people. Rebalance if your portfolio drifts too far from your target mix, but avoid making emotional changes based on short-term headlines.

Ready to Invest and Make Money Work for You?

At Griffiths, Dreher & Evans, PS, CPAs, we keep investing simple and steady with a passive investing philosophy that follows proven benchmarks like the S&P 500. Our investment plan is built around you—your goals, resources, time horizon, and risk profile. Call us to book your FREE, NO-OBLIGATION discovery meeting today.